Table of contents

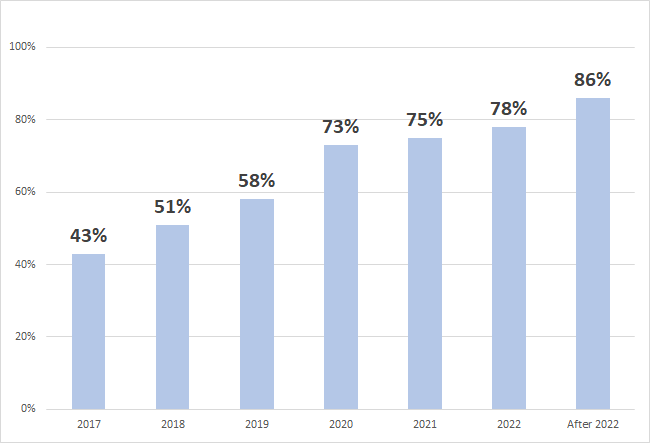

Recently, many companies have moved to a Software as a Service (SaaS) model where customers pay for the services as they go. According to a survey by Bettercloud, 78% of companies said that at least 80 percent of their business applications will be SaaS by 2022.

Portion of Companies Running on SaaS

With so many businesses moving to SaaS, the opportunities for SaaS-based solution providers becomes immense. For those solution providers, it becomes more critical to understand some of the key metrics used to scale and manage their business. A lot has already been written about these SaaS metrics, but given how important they are, it’s worth revisiting.

The five key metrics, or Key Performance Indicators (KPI), associated with SaaS are:

- Committed Monthly Recurring Revenue (CMRR)

- Churn

- Cash flow

- Customer Acquisition Cost (CAC)

- Customer Lifetime Value (CLV)

Why tracking these key metrics is vital to your SaaS business

Any business environment is competitive; however, SaaS businesses face some unique challenges that make this market even more competitive. Based on analysis performed Statista, the software as a service market is estimated to be worth approximately 145 billion U.S. dollars by the end of 2021. And the momentum is expected to continue to accelerate – some countries such as the United Stated are expected to more than double in SaaS revenues in the next five years.

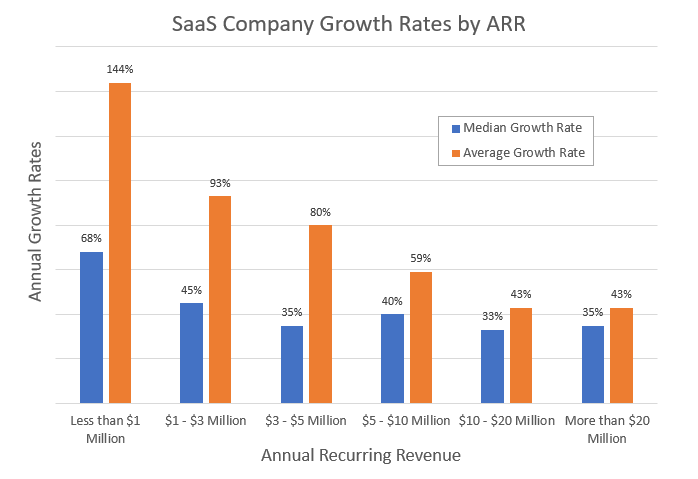

Based on a 2020 survey performed by SaaS Capital, a SaaS business with $2 million in Annual Recurring Revenue (ARR) needs to have annual growth rates over 90% to be in the top quartile of its cohorts. Likewise, a SaaS company with an ARR of $10 million needs to be growing by at least 55% year over year to be in the top quartile, and 20% or more to avoid being in the bottom quartile.

Another way to view this information is by looking at the average and median growth rates of SaaS companies as a function of their current ARR, as shown in the graphic below. Here are a few key takeaways:

- Any SaaS company that is growing at less than 33% year over year is below average, regardless of its current size

- SaaS companies below $3 million in ARR are generally growing by nearly 100% or more each year

- Average growth rates tend to decline as SaaS companies grow in revenue, which is not really surprising since it is difficult to maintain the rocket ship types of growth as the denominator of the growth rate calculation increases dramatically. However, even larger SaaS companies have average growth rates of an impressive 43%

What does all this mean? Growth is even more imperative for SaaS companies than it is for other companies.

To ensure your company is growing at the rate it should be, you need to keep track of revenue, churn, leads, and more. Below we’ll review the key SaaS and growth metrics your company needs to measure and focus on improving to grow.

SaaS Metrics “Cheat Sheet“- Downloadable

Download our consolidated PDF-file outlining the 5 key SaaS metrics.

All five Cs of SaaS are included: CMRR, Churn, Cash Flow, CAC, and CLV. Straightforward definitions of each metric are listed along with a simple graphic to aid in the memorization of these terms or to be used as a quick reference.

Committed Monthly Recurring Revenue (CMRR)

Recurring revenue is that portion of revenue that repeats over a pre-defined period, and is at the heart of SaaS. This represents the fees paid for the software in use on a recurring basis. It can also include managed services, as long as there are ongoing fees associated. Likewise, recurring revenue does not count implementation and other one-time professional services fees collected as a part of customer contracts. Monthly Recurring Revenue (MRR) or Annual Recurring Revenue (ARR) are the most commonly used terms for revenue modeling and analysis.

The Committed Monthly Recurring Revenue, or CMRR, factors in all signed contracts including those not yet in production, as well as contracts that are not going to renew because the customer has discontinued the service or is about to. The CMRR provides the best view of the “steady state” revenue for the business.

Churn

SaaS customers typically sign up for contracts that are month-to-month, annual, or multiple years in duration. When the contract term ends, customers can decide to renew for an additional term. Of course, it is not surprising that some number of these customers choose not to renew, and the rate of non-renewal (known as churn) can have huge implications for the long-term viability of the SaaS provider.

A high churn rate can sink an otherwise thriving business. Much like the recent leak on the International Space Station - if not actively managed, it will lead to very bad consequences. Consequently, every business should closely monitor churn and have a mitigation plan in the event of a spike.

Cash Flow

Cash flow represents the lifeblood of a company because it directly affects the cash balance a company has to pay for all of their operational needs, including their employees, vendors, and service providers. The gross and net burn rate of a company determine its cash flow.

Gross burn rate reflects all the payments made during a given period (typically tracked monthly), including the items identified above, plus debt and finance charges.

Net burn rate is the difference between cash collected and the gross burn rate. A positive cash flow occurs when cash inflows exceed outflows. SaaS companies typically provide cloud-based solutions to their customers, which means high working capital requirements. Additionally, payment terms are sometimes backend weighted or at least due over an extended period of time. Both of these factors make cash flow an extremely important metric to track, especially early on.

Customer Acquisition Cost (CAC)

The cost of acquiring new customers is another critical metric for SaaS companies. The more it costs to acquire customers, the harder it is for a company to expand and achieve profitability.

CAC includes all sales and marketing costs associated with acquiring customers. This is the total sales and marketing spend over a specific time frame divided by the number of new customers acquired during a period.

Although frequently defined in terms of the dollars spent per customer, CAC can also be defined in terms of a payback period. In this case, it represents the number of months of net income required to pay for the acquisition costs. Net income is a customer's revenue generated minus variable expenses. The CAC payback period is a statement in months, of the time to fully pay back your sales and marketing investment.

Customer Lifetime Value (CLV)

The customer lifetime value is the expected profit from a customer throughout the entirety of the relationship. As such, it represents the net present value of the profit streams minus acquisition costs for that customer.

The expected profit is directly related to the length of time that a customer remains as a customer. Hence, the lower the churn rate, the higher the renewal rate, and the longer that customer remains as to contribute to company profits.

These five metrics provide a financial report card for any SaaS company. Each metric has a significant impact on overall cash flow. Also, each metric directly affects the others. For example, holding other variables fixed, the higher the CMRR or the lower the churn, the greater the CLV.

As with any financial planning approach, the faster you can re-forecast and address unexpected shifts in these 5 key metrics, the better prepared you are to absorb financial stress. In order to do this, you need an agile solution, and our team is happy to help you prepare for the uncertain future and increase your business agility – See how.