Table of contents

- Download Our Free Sample Sales Compensation Plan

- Sales Compensation Plan Defined

- Sales Compensation Plan Examples

- 1. Salary Only Compensation Plan

- 2. Commission Only Compensation Plan

- 3. Base Salary Plus Commission Plan

- 4. Base Salary Plus Bonus Compensation Plan

- 5. Absolute Commission Plan

- 6. Relative Commission Plan

- 7. Territory Volume Commission Plan

- 8. Straight-Line Commission Plan

- 9. Gross Margin Commission Plan

- 10. ‘Draw Against’ Commissions Plan

- How to Create a Sales Compensation Plan

- Begin Creating Your Compensation Plan

Download Our Free Sample Sales Compensation Plan

Fill out the brief form below to get our sample sales compensation plan from CaptivateIQ.

Sales Compensation Plan Defined

A sales compensation plan combines base salary, commissions, and incentives to establish an employee's earnings. A good sales compensation plan drives increased individual performance while facilitating revenue growth. These plans are dependent on an employee's role, the length of the sales cycle, the types of sales being performed, as well as the seniority of the employee. These compensation plans can apply to sales representatives, sales engineers, customer support representatives, sales/business development representatives, as well as management employees. Thanks to these factors, no one plan works for everyone and it is often hard to find the one that best fits your business.

Sales Compensation Plan Examples

When choosing a sales compensation plan there are several different structures to choose from. Sales compensation plans can be very simple or they can be very complex depending on the plan that is chosen. Some examples of sales compensation plans are salary only, commission only, base salary plus commissions, and many more. Now, let's take a deeper look at these individual structures. Source.

1. Salary Only Compensation Plan

The salary only compensation plan is the simplest sales compensation plan as employees are paid a single sum and are not paid commissions. This is most commonly used for employees outside of the sales and support roles where they have minimal influence on sales. One benefit of a salary only compensation plan is that it helps encourage collaboration as there is no source of competition within and across teams. In this plan, regardless of performance, employees are paid the same.

2. Commission Only Compensation Plan

When using a commission only sales compensation plan, employees are only paid when they achieve specific goals, such as closing a deal or achieving a customer renewal. This plan is more common in businesses without a lot of financial backing. This style of compensation planning strongly incentivizes sales and encourages growth. Although this is helpful, this can also result in a team that is more focused on closing sales than building relationships and creating lasting customers. One benefit to this plan is that employees can operate almost entirely independently which results in low administrative costs. Similar to a salary only compensation plan, the simplicity of a commissions only plan makes determining an employee's compensation fast and efficient. However, employees are never entirely sure what they will earn.

3. Base Salary Plus Commission Plan

The base salary plus commissions plan pays employees a base salary that is typically smaller than the average employee salary and is supplemented by additional commissions. This approach strikes a middle ground between the previous two plans and is a very common approach. This sales compensation plan helps incentivize sales while also maintaining good relationships with customers. To incentivize more sales, commissions can be uncapped meaning that it is up to an employee to determine how much money is earned. This method also promotes stability as employees have a more consistent paycheck than the commissions only method. Although more complex than the plans above, this method is still relatively simple, especially for small businesses.

4. Base Salary Plus Bonus Compensation Plan

The base salary plus bonus compensation plan pays employees a base salary as well as a bonus if they achieve certain goals in a specified time. Unlike a base salary plus commissions plan, this salary should not be less than a typical salary. The benefit of a plan like this is that it is much more predictable. As time passes it will become clear which employees are closing in on their quotas and who are not and businesses can prepare to spend more or less on employee salaries. One downside with this method is that once a bonus is achieved, it may be difficult to incentivize increased performance. This method is slightly more difficult to put in place as it requires coming to an agreement on the goals to achieve the bonus.

5. Absolute Commission Plan

An absolute commission plan pays employees strictly commissions, however they are only paid once they surpass a designated milestone. For example, a sales representative can be paid a certain sum for every three new customers they gain. With an absolute commission plan, different tasks and objectives are given different monetary values. This helps employers make it clear which tasks are of greater importance as these tasks are given greater compensation for completion. One common problem with this kind of compensation plan is that it can be difficult to provide fairness among sales representatives. Due to the different opportunities presented in different territories as well as variations in individual goals, it is possible that the focus of your business can be lost.

6. Relative Commission Plan

A relative-commission plan pays employees based on their performance against their quota, in addition to their salary. In other words, team members earn a commission based on how much they achieve relative to the quota set for them. Absolute commission and relative commission are often mixed up. Relative commission is more focused on money and revenue, while absolute commission can shift an employee's focus to other overarching sales goals, like acquiring new customers. Relative commission plans aren’t as risky to a business as compensation is linked to performance. This type of compensation plan can be tricky as it relies on accurate quotas to provide appropriate compensation to sales representatives.

7. Territory Volume Commission Plan

A territory volume compensation plan only works well when your employees work in a very team-oriented environment. This plan calculates compensation based on the achievements in a given territory. For instance, all sales within a territory are added up and commissions are distributed evenly to all representatives responsible for a given territory. This method of compensation removes all of the individual pressures associated with sales and instead focuses on team building. Although this plan has the opportunity to facilitate a very communicative and collaborative work culture, problems can arise if individuals fail to carry their own weight, as other employees will lose out on compensation opportunities.

8. Straight-Line Commission Plan

Similar to a relative commission plan, a straight-line commission plan pays employees based on how much of their quota they hit. However, there are two main differences. The first is that compensations are not supplemented by salaries, meaning that employees are only paid a commission. The second main difference is that individuals can surpass their quotas. For example, if a person sells 50% of their quota they are paid 50% of their commissions, but if they sell 150% of their quota they will earn 150% of their commissions. This compensation structure can be very expensive for a business as you can pay higher than expected compensation, however it provides a limitless incentive to employees to increase sales and revenue.

9. Gross Margin Commission Plan

The gross margin commission plan looks at actual profits as opposed to revenue when determining compensation. The gross margin is the actual amount of profit an employee earns for their business after taking the cost of goods sold into account. This brings attention from revenue to actual profitability. When using a gross margin commission plan, a person's commission is calculated based on their profitability. This can be used to deter employees from using discounts to hit their quotas in an attempt to avoid selling costs, which can be costly as customers begin to expect discounts.

10. 'Draw Against' Commissions Plan

A draw against a commission plan is a compensation plan that is based completely on commissions. During each pay period, the employee is guaranteed a sum of money, and then depending on the agreement, a draw is deducted at the end of the commission's cycle. This compensation plan can get complicated, however it is useful when employees first start in a new role as they can structure the draw agreement accordingly.

Recoverable Draws

A recoverable draw is a payout that employers pay to employees that are then expected to be gained back by way of employee commissions. For example, if you pay an employee a draw of $10,000 a quarter, you anticipate that they will earn at least $10,000 in commissions that month and any amount below that will roll over into the next commission's window and thus the business does not lose any money while paying draws.

Nonrecoverable Draws

Unlike a recoverable draw, a nonrecoverable draw is a payment that you don't expect to gain back. If the employee earns a greater commission than the draw they are paid, the business pays the difference. If the employee does not hit their mark, no amount will be rolled over and the business loses the difference. This system is beneficial when an employee is first being added to a team as they may need more time to begin being paid commissions.

How to Create a Sales Compensation Plan

Now that we have discussed various examples of sales compensation plans, it is important to understand how to choose what plan works best for your business. There are six steps you should take when creating a sales plan. These steps are framed by important high-level questions that examine the goals of your business. These six steps are:

- Use An Integrated Solution

- Determine Sales Compensation plan goals

- Choose Type of Sales Compensation Plan

- Choose a Payroll software

- Set Quotas and Expectations for Compensation

- Maintain Your Sales Compensation Plan

1. Use An Integrated Solution

In order to turn your sales compensation plan into a competitive advantage it is important you have the right tools to do so. CaptivateIQ provides real-time insight into your sales compensation plan thanks to automated data syncing and the flexibility to customize compensation plans on the go. All of these features provide a robust and effective sales compensation plan that is backed by real data surrounding your business.

2. Determine Sales Compensation Plan Goals

Like any plan within a business, it is important to understand the high-level goals before setting individual ones. Sales compensation plans are designed to help make company goals a reality. By setting goals alongside sales quotas, your business will have a clear picture of the direction you want to go. Examples of goals can be to increase revenue, increase repeat customer rates and decrease selling expenses.

3. Choose Type of Sales Compensation Plan

Above we have listed 10 of the most common and useful structures of compensation plans. Using these descriptions and your knowledge of your business, choose the option that will add the most value to your organization. Aside from the structure, it is also important to clarify when commissions will be paid. There are four common times to pay commissions when a customer signs a contract when you receive the customer’s first payment, every time a customer pays, and when deal goals are reached.

When Customer Signs a Contract

This form of compensation plan pays employees their commission each time a customer signs a contract. This means that regardless of when and how often the customer pays, the representative receives a commission once the contract is signed.

When You Receive the Customer’s First Payment

This form of compensation plan pays each time a customer pays. Unlike the previous plan, this plan requires customers to follow up on their agreements before employees are paid. This is a safer play for businesses as there are plenty of circumstances that result in a deal falling through before payments are made. This system also holds people accountable for their accounts.

Every Time a Customer Pays

This compensation pays every time a customer submits a payment. This requires that the appropriate personnel make sure that they keep track of customer payments. This way, outstanding accounts receivable balances are more likely to be paid as employee's commissions depend on it.

When Deal Goals are Reached

Finally, this compensation pays at the end of a deal. For example, if a deal specifies a certain quantity of products to be sold they will not be paid until the final sale. This takes the “Every Time a Customer Pays” method to another level as instead of holding representatives accountable for individual payments they are instead responsible for the deal as a whole and as a result they are obligated to see the deal to the end.

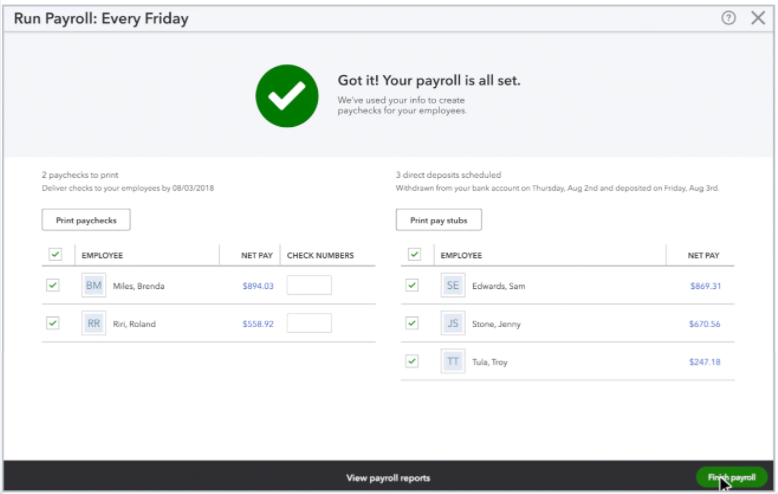

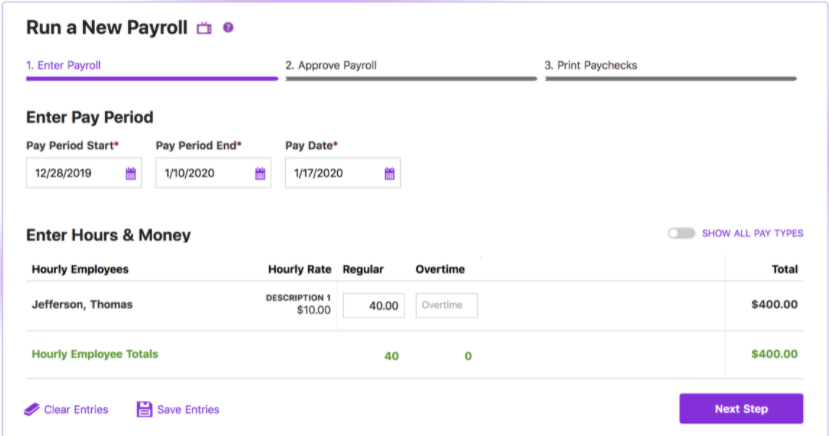

4. Choose A Payroll Software

After settling on a sales compensation plan, you must determine how you are going to pay your employees. Payroll software provides automated services with several different technologies to choose from. Each software provides different benefits and specialties. As a result, when choosing the payroll software that is right for your business, you understand the goals and payment plan you have decided on. The software that you choose also depends on the size of your business and what your HR team looks like. Some examples of payroll software are:

Each of these software provides different benefits. For an all-around software that brings your various data sources under one roof to power fast, real-time calculations, Gusto might be the software for you. If you are willing to spend the money and want to save time with automatic payroll tax calculations, paycheck accuracy, and native payroll integration for your accounting software, go with Intuit Quickbooks payroll. On the other hand, if you are a small business in need of the bare minimum, Patriot software payroll provides an inexpensive option as well.

5. Set Quotas and Expectations for Compensation

Oftentimes quotas are central to compensation plans. If your compensation plan requires a quota, these quotas must be both challenging and obtainable. When setting quotas there are typically two schools of thought: the Bottoms-Up and Top-Down approaches. Aside from quotas, managers must set expectations of commissioned employees such as what benchmarks they are expected to hit and which territories to explore.

Bottoms-Up Approach

The bottoms-up approach requires managers to have a strong understanding of the capabilities of individual team members as well as potential market opportunities. Based on these data points a manager can set quotas they believe are challenging but achievable.

Top-Down Approach

Unlike the Bottoms-Up approach, the Top-Down approach does not start with the capabilities of representatives but instead identifies revenue targets and market opportunities to identify how many sales your representatives should close. Some larger businesses also use this method to help evaluate sales teams and identify areas that may need improvement or more help.

6. Maintain Your Sales Compensation plan

Like your business, a sales compensation plan is dynamic and it is only a matter of time before you see your plan begin to change. As products, team members, competition and company goals change it is important to continue to revisit your sales compensation plan. A stagnate compensation plan will result in unmotivated team members or impossible goals. Both of these situations lead to a loss in productivity and focus within your sales team. Make sure to keep your sales compensation plan up to date or you run the risk of falling into these time sinks.

Begin Creating Your Compensation Plan

Now that you have seen what it takes to create a compensation plan it is time you try for yourself! Remember, like your business your sales compensation plan is ever changing. To create a plan that keeps your team members motivated while continuing to drive revenue growth you must continue to evaluate the driving questions that you must ask yourself when you begin creating your plan. By never losing sight of the goals and market opportunities in your field, your sales compensation plan for your teams will keep your business moving in the right direction.