Table of contents

Previously, we looked at the 6 C’s (key financial metrics) for SaaS companies. Having this background knowledge is a great start, but is not all that helpful without the right business model. In this article, we will look at the components of different SaaS financial models and how to use them.

What is a SaaS Financial Model?

A financial model is a tool that helps bring together all of the key elements of company expenses and revenues into a single, consolidated set of calculations. For SaaS companies, this financial modeling is tailored to enable forecasting subscriptions, bookings, billings, renewals, churn, and revenues. It also addresses cost of sales for SaaS and subscription-revenue businesses with multiple subscription plans, pricing tiers, or contract lengths.

Any financial model takes historical company performance as well as relevant industry data and outputs forecasts future scenarios. The key differentiator when considering how financial models change across industries and revenue models is which variables are of the most interest. With SaaS companies, the primary focus is on users, subscription fees, churn, Customer Lifetime Value (CLV), and more. Each forecasted metric should be relevant to the company’s core business model.

For early stage SaaS startups that are just beginning to build out their SaaS financial model, using a fairly simple, spreadsheet-based model can be a good step in the right direction. There are numerous SaaS financial model templates available to get one started, including this one from efinancialmodels.com.

However, successful SaaS companies typically outgrow such a simple model as their modeling becomes more complex and harder to maintain. This is where best-in-class planning solutions provide Saas financial modeling software to develop and maintain financial models that will grow with the company needs. These solutions can leverage other company data sources such as customer pipeline, current customers, and expenses in an automated fashion.

Model 1 : Financial Operating Models

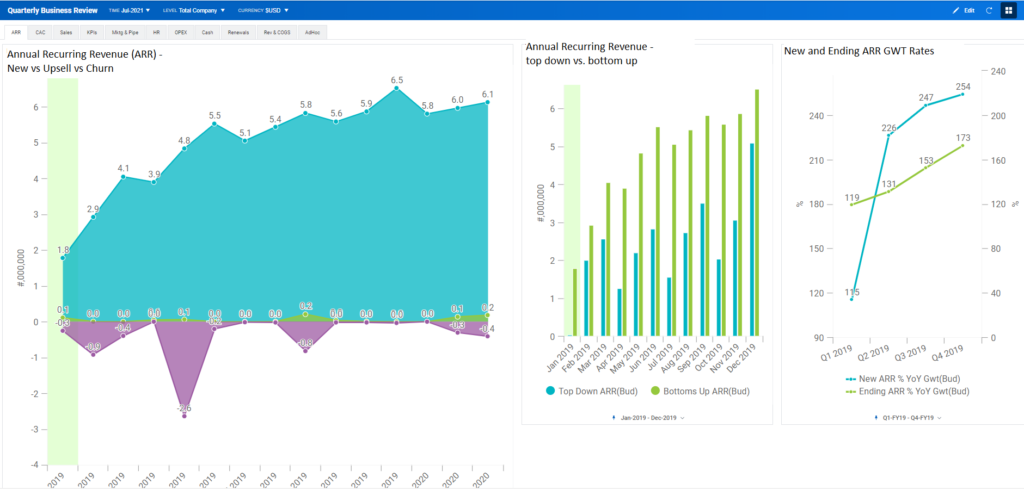

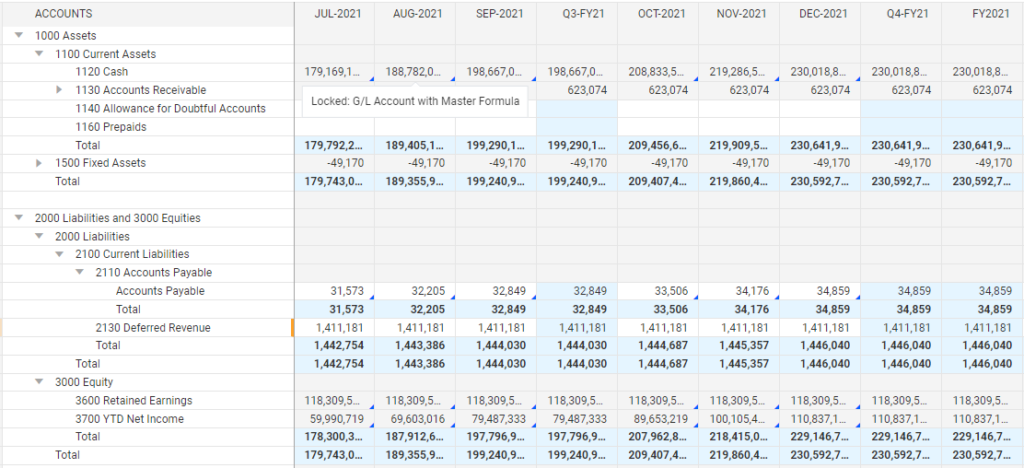

This is the backbone of any SaaS financial model. Operating models are very simple, and consist of views of the balance sheet, cash flow statements, and monthly profits/losses. There are a number of benefits to viewing actual numbers side-by-side. Many times, it can help spark new ideas that can be tested with more complex forecasting techniques.

While there is room for flexibility in the other types of SaaS models, there is no reason to get extra fancy for this one. These are used for virtually every profit-generating enterprise, from a diner in Fargo to a Fortune 500 company. Just remember — do not manually enter these numbers! Save time by using a simple data export from your accounting software.

Model 2 : Financial Forecasting Models

Business areas that need special attention require forecasting models. For SaaS companies, this generally involves future revenue and employee costs. Let’s take a closer look at both of these.

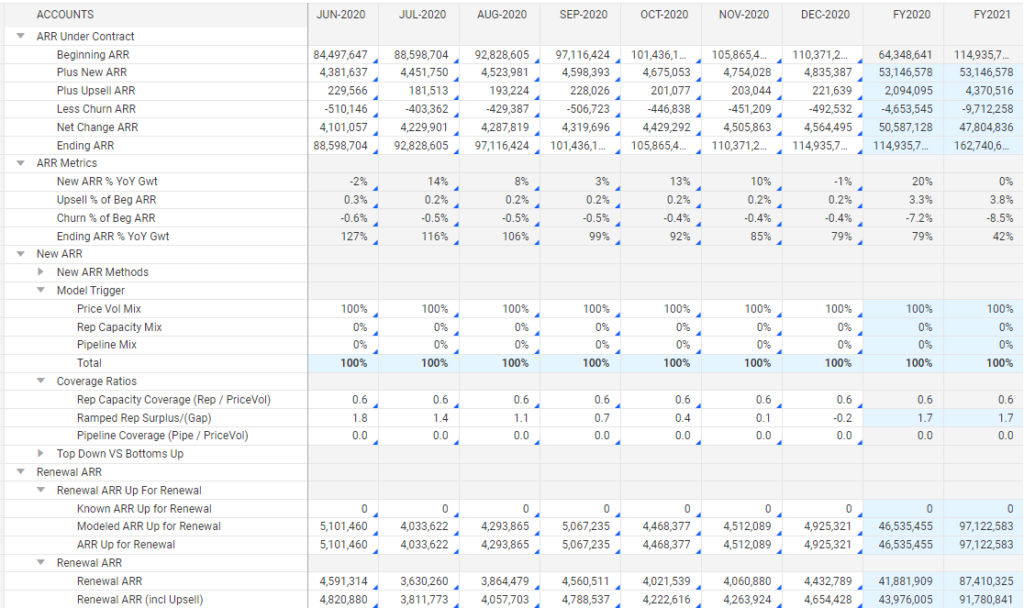

Revenue Forecasting

To predict revenue meaningfully, you must be well-informed about your customer base and market size. This can mean many different things, but having historical churn, CPC, CAC, MRR, ARR data is always a great start. If there is any confusion about these terms or how they fit into your overall business plan, make sure to do ample market research. A pre-seed tech startup might weight churn more than MRR, and a company in the middle of an intensive marketing campaign might pay less attention to CAC.

Another key component to building out a revenue forecast is the development of a marketing pipeline. How do you plan on bringing new customers into the fold? This should be some combination of the following:

- Paid Advertising

- Content Creation (blogs, webinars, etc.)

- Organic Leads

With SaaS companies especially, customer loyalty is the name of the game. Therefore, Customer Retention Cost (CRC) is another important component to consider in a forecasting model.

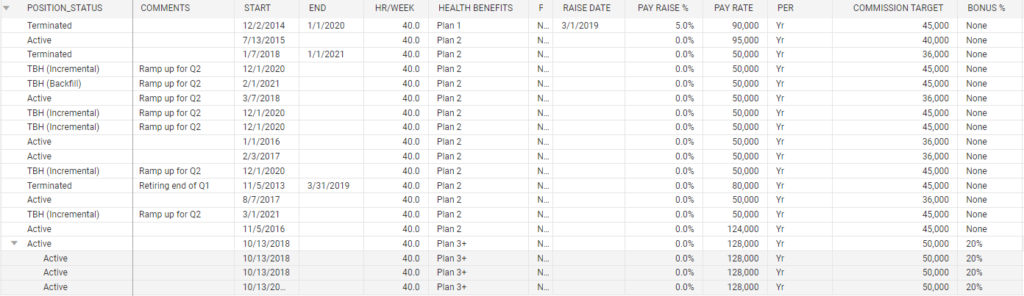

Employee Costs

For most Saas companies, their payroll costs are by far the largest expenses to deal with.

Payroll is relatively straightforward to map out in the short-term, but forecasts depend on the specifics of your hiring plan. This does not just include full-time employees but also independent contractors. Import data from your operating model to get an accurate picture of budget availability both now and down the road.

This is a relatively simple model to develop, but is quite often overlooked. When a SaaS company experiences explosive growth and hasn’t quantified a hiring plan, there can be potentially devastating consequences.

Model 3 : Financial Reporting Models

Reporting models take in data from outside sources and present it in ways that allow easy visualization of KPI progress. Also, presenting data in this form allows new insight into existing goals and allows people not on the “front-line” of the financial modeling process to have input.

Best practice is to have reports in the context of forecasting scenarios. Once again, these can vary, but should be something along the lines of:

- Best-Case: Reach for the stars, land on the moon. This is the best possible outcome you and your team believe that can be achieved.

- Conservative projections: Goals that take into account historical metric performances and revenue forecasts to determine what expected growth should look like. Anything below this is a disappointment.

- Worst-Case: It might not be fun, but having an idea of what to do if everything goes wrong is worth it in the long-run. Hopefully, you never have to experience this, but at least you will be prepared if you do.

Managing various forecast models can be handled and maintained much more effectively when using a financial planning solution rather than spreadsheet-based models using Excel.

How Should I Decide on Which Financial Model to Use?

Especially for younger companies, it is critical to develop a financial model that incorporates both short and long-term needs. Here are the 4 main criteria that should be considered when analyzing whether a specific financial model is right for your company, as well as guiding questions.

- Quality of Financial Statements: Is there a cash flow statement, income statement, and balance sheet?

- Depth of Analysis: How many relevant SaaS and/or financial metrics are included? Can multiple scenarios be modeled? Are you able to compare your financials within the industry?

- Revenue Forecasting: How easily can new subscriptions be added into the model? Can subscription tiers/levels be incorporated? What types of contracts can be modelled?

- Cost Modeling: Can you break down costs by department or P&L category? How easily can deal terms with 3rd party vendors and suppliers be changed?

Let us help you build a financial model for your SaaS company

Whether you are new to building financial models or you already are knee-deep in an existing SaaS financial model, we can help you move to the next step. Does you Excel-based model entail more than 20 sheets? Is it hard to open or force you to turn off “Calculate Now” so it does not endlessly spin while you wait for it to complete? Are you using a financial modeling software solution but still not getting what you need from it? We can help and would be happy to have a conversation with you about your needs.