Table of contents

Microsoft Excel has become a beloved tool by many, especially by those in finance, however the program that revolutionized accounting in 1980 has not kept up with the evolution of this industry. Today, most CFOs are urging their staff to stop using this archaic tool for the sophisticated analyses they are conducting. Spreadsheets are an inefficient use of time, difficult to collaborate on, and are highly prone to errors. It is time for finance teams to move towards spreadsheet alternatives.

In the best case, using spreadsheets for financial management can mean a company is wasting a tremendous amount of time manually importing data. In the worst case, this can lead to disastrous errors of which the source is nearly impossible to identify. This is why having a more powerful tool with a single source of truth is absolutely critical for finance teams of large, or growing, companies. Source.

Without a spreadsheet alternative, you’re wasting time

During the abrupt shift to remote working in 2020, the shortcomings of excel as a finance tool were truly brought to light. Glenn Hafler, a principal at advisory firm Hackett Group Inc. supported this idea when he said “the pandemic really exposed the vulnerability that finance teams have as a result of their dependence on Excel.” Since remote collaboration during this time was unavoidable, seamless and instantaneous updates from a multitude of users was absolutely necessary. Companies stuck on simple spreadsheets likely struggled tremendously during this time since they were prone to errors from a lack of version control. In today’s global marketplace, there is no room for this kind of time suck if a business wants to keep up with competitors. Source.

Manually inputting data, which is still done by many users, can be time-consuming and lead to unnoticed errors, especially when employees are dispersed in remote locations. In these cases, spreadsheet alternatives can save the day.

Adobe Inc.’s finance chief Mark Garrett explains why he is insisting he and his team phase out spreadsheet use for their processes. “I don’t want financial planning people spending their time importing and exporting and manipulating data, I want them to focus on what the data is telling us,” Garrett said. If financial analysts waste less time with manual inputs, and check or fixing errors, more time can be allocated to actually analyzing and drawing conclusions.

Let’s dig into several reasons why finance teams are looking for financial planning software and other spreadsheet alternatives.

Reason #1: Spreadsheets are difficult to share

As we’ve discussed, the shift toward remote working emphasized the lack of collaboration capabilities within spreadsheets. This is largely due to the difficulty of sharing these files. In order to accurately draw conclusions from your company’s data, it must all be brought together in one location. This can be very difficult to do for a business relying on spreadsheets. ‘Data chaos’ is likely to occur which is when data is disparate and hard to merge. In order for this consolidation to happen, emails are commonly exchanged with local spreadsheet files that are downloaded by the recipient. Then data is manually copied and pasted together, which is an unnecessarily cumbersome task for this day and age. Not to mention, financial data can rapidly change so static files may go out of date extremely quickly, making them no longer valid. Source.

In 2011, Microsoft updated Excel and added it to Microsoft 365, allowing for cloud storage capabilities. This did increase its collaboration potential; however, this did not take away CFO’s desire to move away from Excel and toward a more sophisticated tool. Even if cloud storage is used for spreadsheets, version control errors may still occur with a large number of collaborators which will take time to sift through. Additionally, as we’ve mentioned, simple spreadsheets just don’t have the ability to perform analysis like modern financial software tools. Source.

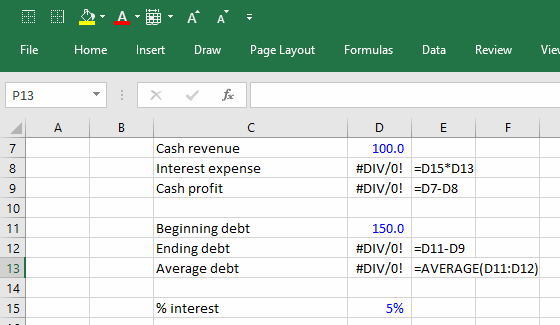

Reason #2: Formulas are hard to use and create

Excel may be loved for its simplicity and straightforward user interface, but inputting useful and accurate formulas can be a nightmare. Anything beyond the most basic calculations of adding or multiplying a few cells, can lead to long, complicated strings of formulas. These can also be difficult to interpret and inspect due to the nature of the formula structure. There have been several documented instances of major businesses incorrectly reporting financial findings due to human errors within a spreadsheet. In some cases, it simply led to wasted time, and in others there were serious repercussions such as unintentional false promises to shareholders.

Additionally, the limited capabilities of spreadsheets are typically limited even further by the user themself. People tend to have a collection of regularly used graphs or pivot tables of which they are comfortable. This leaves you prone to data distortion since your numbers are likely always being visualized and modeled in the exact same way, time and time again. In order to find meaningful insights, data must be presented in the right way. Line graphs and pie charts are not always going to be sufficient.

Reason #3: Data security issues

Lastly, an important implication to consider while using spreadsheets is the lack of data security. Files being shared via email are at high risk to be hacked. It is well established that most cyber-attacks originate over email so important data files are not safe in these systems. If data security is a top priority of your business, moving away from spreadsheets must also be a top priority for your team.

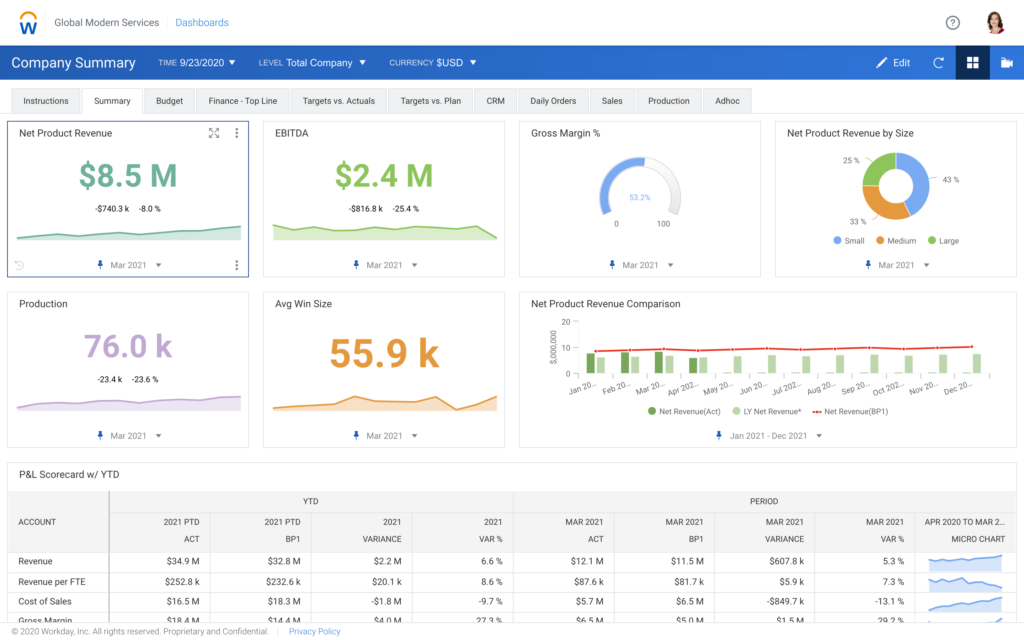

The perfect spreadsheet alternative for finance teams: Workday Adaptive Planning

All this isn’t to say there is never a time or place for spreadsheets in modern business. They are suitable for some simple, everyday tasks but they are also very restrictive and require a lot of manual input. This is why spreadsheet use may be holding your business back, especially in regard to financial planning. Learn more about the benefits of financial planning automations.

Most CFOs are now looking to replace excel and find a more robust financial planning software. Those looking to drive their business further, have several options for innovative, cloud based programs to handle their FP&A needs. Generally, it is most important to focus your search around adaptability, automation, and user experience. These features will ensure the transition away from spreadsheets is as seamless as possible and worth it in the end for the benefits the new tool brings.

A few popular cloud based programs are Workiva Inc., Anaplan Inc., and Workday Adaptive Planning. All of which have individual benefits but the Workday Adaptive Planning program addresses and resolves all of the spreadsheet issues explored in this article. Learn more about the pros and cons of Workday Adaptive Planning versus Anaplan. For a company looking to strengthen their FP&A capabilities, Workday Adaptive Planning is a great choice. It is cost effective, customizable, and intuitive to use, which is important for those accustomed to excel.

QBIX Analytics is here to help you transition away from spreadsheets and implement the right financial planning software for your company needs.