Table of contents

What is Corporate Financial Planning and Analysis?

For businesses, it is critical to manage and execute comprehensive budgeting and forecasting in order to maintain financial prosperity. This process is known as corporate financial planning and analysis, or FP&A. Corporate FP&A is used to establish and reach short and long-term financial goals for the company. This is typically done by an in-house team of analysts who provide annual company budgeting based on various cash flow forecast models to be used by senior management.

The goal is to provide the company with data-driven answers to important business questions. Thanks to developing technology, financial planning and analysis has evolved in recent years to be less reactive and more proactive. Previously, FP&A analysts would extrapolate data for the predicted costs and revenue by utilizing historical financial data. However, with an influx of new and effective data analysis technologies to be used by the analysts, the efficiency and accuracy of these forecasting models have significantly improved.

Financial planning and analysis varies from accounting by the point in time at which the analysis is to be focused. Accountants generally review past financial data in order to identify the current financial status of the company, whereas FP&A analysts focus on the predictions for the future based on current and past financial data. Source. Source.

FP&A Skills & Responsibilities

The fundamental role of any FP&A team is to provide the necessary analysis and conclusions in order to allow the senior executives and management to make important company decisions in terms of operations, finances, and business strategy. The team is responsible for generating the annual budget plans and producing up-to-date financial forecast models, as well as variance analysis on these plans. This is done primarily by producing and analyzing the following reports:

- Profit and loss statements

- Profit margins

- Budgeting

- Scenario planning

- Ad-hoc reporting

The necessary skills for a FP&A analyst are almost identical to those of an accountant; therefore, it is not surprising most analysts have done both if they have experience with corporate financial planning. In order to be a successful FP&A analyst, one must have extremely strong math skills and a passion for number crunching, in addition to a savviness with various software tools. Unlike an accountant, they also must be very comfortable managing intricate and diverse sets of data from marketing, sales, HR, and operations.

Depending on the software programs used, the specific knowledge needed may differ, but a thorough understanding of common formulas and automation strategies in order to manipulate data and produce reports is essential for any FP&A analyst.

It is also critical for members of the FP&A team to have strong business partnering skills, good collaboration abilities, and a deep understanding of the goals and priorities of the company. They are constantly working with colleagues from various sectors of the organization so FP&A analysts must be able to effectively communicate and work with others, which includes conveying complex data and findings in a straightforward manner to those with different professional backgrounds. Source.

Building an Effective Corporate FP&A Team

The corporate FP&A team at every company may look different, depending on size and complexity. Smaller businesses may find that tasking an accountant (or similar employee) with additional FP&A responsibilities may be sufficient. As the organization grows it will likely be necessary to have an analyst or team dedicated solely to financial planning and analysis activity.

This transition ideally entails moving an existing accountant into FP&A if they are ready for new challenges because having previous knowledge of the company’s historical financial status and operations will prove extremely beneficial. In this case, the company should also strongly consider paying the newly reassigned analyst to obtain a financial planning and analysis certification (FPAC). If the new role is filled by an external hire, it is recommended to look for a candidate with this existing credential.

The structure of the team may evolve over time. When the group has only one or two analysts they may report directly to the CFO, but as the team grows it is recommended to add a director who reports to the CFO and all analysts report to this director. Source.

Financial Planning and Analysis practical applications

Within a business, there are a number of different operations that the FP&A team performs almost every day in order to provide up-to-date information to company leaders and employees alike. The most central of these tasks is creating a short-term and long-term plan to detail company activities moving forward.

When creating these plans FP&A teams are required to create fixed budgets and forecasts to plan for expected expenditures, sales revenues, and product developments. Along with creating forecasts, FP&A teams need to compile current and historical company data in order to provide up-to-date reports that detail company performance in areas such as cash-flows, revenue growth, and budgeting on an annual, quarterly, and monthly basis.

No FP&A team is exactly alike, and different businesses demand different services from their teams. FP&A teams are your business’ primary insight into the future, and the sooner they are able to make accurate forecasts, the more successful your business will be. Source.

Planning, budgeting and forecasting

Before your business can jump right into selling their products it is important to have a clear understanding of two basic questions surrounding your company.

- How much can your business spend?

- How much can your business plan to sell?

By answering these questions FP&A teams can help turn company goals into realities.

In order to answer these questions, FP&A teams use current and historical data to make accurate predictions into the future to provide insight on company spending as well as revenue expectations and other benchmarks that help drive company growth. Historically, after these forecasts are made FP&A teams would then begin the process of creating yearly, largely static, budgets.

However, budgets for fast moving companies can quickly become obsolete, mandating the need for continuous planning. This action of continuous planning allows for greater business agility as corporate financial planning and analysis teams are constantly updating company budgets and forecasts as different business environments develop. Source.

Strategic planning

FP&A and strategic plans go hand in hand. The strategic plan is a top-down, senior management driven document that sets high-level targets in areas like revenue, net income, core strategic initiatives and investments. This plan details goals that often take years to achieve. It is the job of the FP&A teams to digest this strategic plan and break it down into smaller, more manageable goals that drive the business in the direction of the strategic plan. As a result, FP&A teams often act as the link between the different departments in your organization as they provide each group with the goals and responsibilities during a given period of time.

Operational planning

Strategic planning lays out the direction and future goals of the company, while operational planning is the road map for achieving these plans. Operational planning is a critical aspect of corporate FP&A and can not be overlooked by any successful team. Even with the perfect strategy for financial goals, tangible initiatives must be set in order to guide the organization along the way. The company’s strategy may get lost along the way without specific instructions for each team to follow. It can be challenging to establish a clear and realistic operational plan directly from a high-level strategic plan. There are a few main tactics that should be used in order to support this process.

Firstly, deconstruct large goals into smaller targets in a cascading fashion until the tangible actions can be found. Next, make sure your plans are supported by your budget, and if not, one or both may need to be altered. It is also important to foster a culture of accountability and consistently monitor progress in order to stay on track. However, being adaptable and course-correcting when necessary is just as vital. Lastly, leveraging technology to optimize the execution of the strategic plan can be extremely beneficial. It is important to look for a solution that can be implemented easily, supports adaptable planning, and monitors progress.

With the correct software tools, operational planning can become a straightforward and highly responsive practice for a company.

Capital planning

Capital planning is another key component to developing a feasible strategic plan and is focused on the budgeting for long term goals of the company. Essentially, it is used to determine whether the organization has the necessary resources to allocate for future plans and certain long-term investments are worth funding. Generally, capital planning is used minimally and applied only when a large amount of resources are at stake for a non-essential investment. This is when the financial implications and predicted benefits must be weighed in order to make a decision on the value of the expense.

Workforce planning

The financial plans laid out above tie directly into the workforce planning of the company. While traditionally workforce planning has been a responsibility of the HR team alone, more and more emerging predictive and forecasting tools have allowed the FP&A team to take a key role in the process by creating more data-driven decision making. Since the FP&A team focuses on maintaining financial health and the HR team handles the employee lifecycle, both teams need insights from the other in order to effectively do their jobs. Therefore, it is most effective to connect the two and develop a holistic, dynamic plan in terms of budgeting and workforce.

Profitability analysis

Profitability analysis reveals a company’s ability to effectively generate profits and evaluates the direction of performance. This process entails analyzing current and historical financial data to calculate both expected company expenses as well as revenues during designated accounting periods for particular sectors of the business. Some of the key profitability ratios to be established include gross margin, operating margin, and free cash flow margin.

The results of this analysis will likely influence the direction of the strategic, operational, capital, and workforce planning.

What Tools Does FP&A Need?

The number one difficulty most FP&A teams face is efficiently collecting and managing data. According to an AFP survey, this challenge consumes 75% of the time spent by a company’s FP&A team, primarily because they lack access to source systems.

Currently, excel spreadsheets are still widely used which is generally a very inefficient method of data management. Spreadsheets are prone to error, often slow to process data, and restrict collaboration. Moreover, the conclusions drawn from this data are often undervalued by senior executives due to a lack of confidence in their validity, even though these results are critical to guide decision-making.

Tool Category 1: Financial Planning Tools

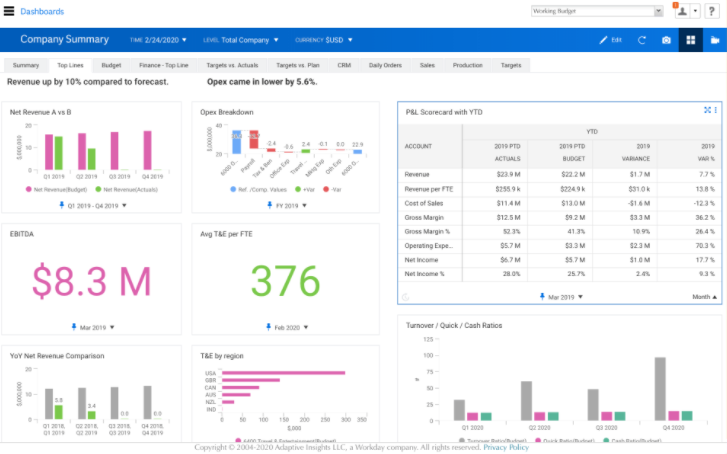

An obvious need for effective FP&A at any company would be a comprehensive financial planning tool. This tool will assist in executing the various functions and deliverables laid out above for thorough financial planning, reporting, and analysis. The FP&A team can leverage their system to quickly and accurately produce budgeting plans and financial forecasts.

A widely trusted financial planning tool is Workday Adaptive Planning for finance. This system is an enterprise performance management (EPM) solution that encompasses all of the necessary components for the financial planning process. This EPM allows for streamlined collaboration throughout the company and enables automated data integration with other systems such as those identified below, so time is no longer wasted on importing and exchanging data, and confidence in your financial models will increase. This solution is comprehensive and adaptive to any company’s needs.

Tool Category 2: Enterprise Resource Planning Tools

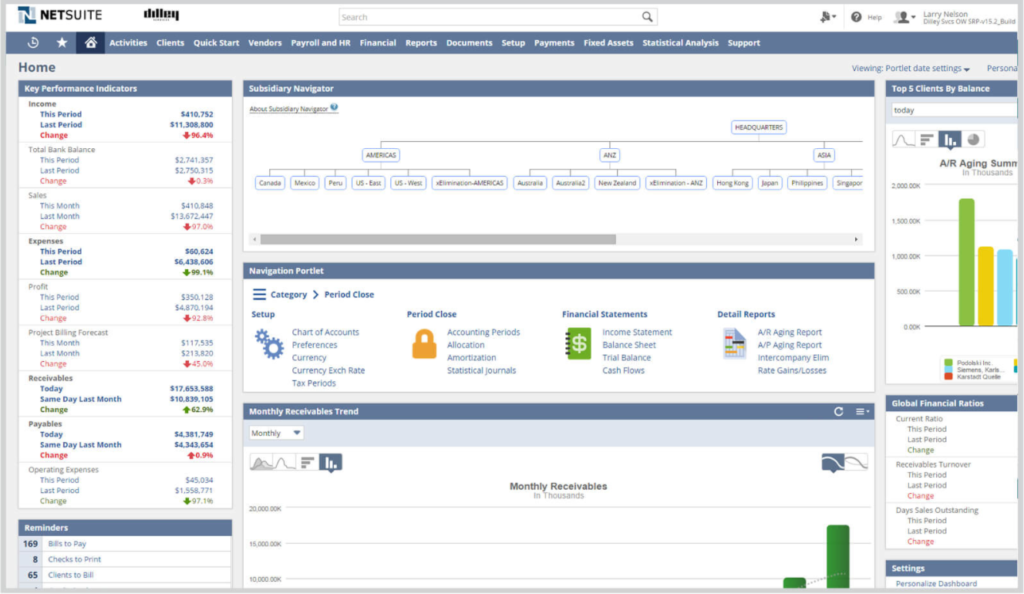

Enterprise resource planning (ERP) is a key component to the process of FP&A. ERP tools manage a business’s day-to-day activities in accounting, project management, procurement, supply chain operation, and risk management and compliance. ERP software systems enable data from distinct business processes to be compiled in one common hub, allowing effortless updating and crossover. This verifies data integrity and eliminates duplication, leading to a single source of truth.

When choosing an ERP software, it is important to consider the current and future needs of your organization, and research your options. Two highly trusted ERP tools are Oracle Netsuite and Microsoft Dynamics 365, both of which provide data security and flexible scaling for your growing business.

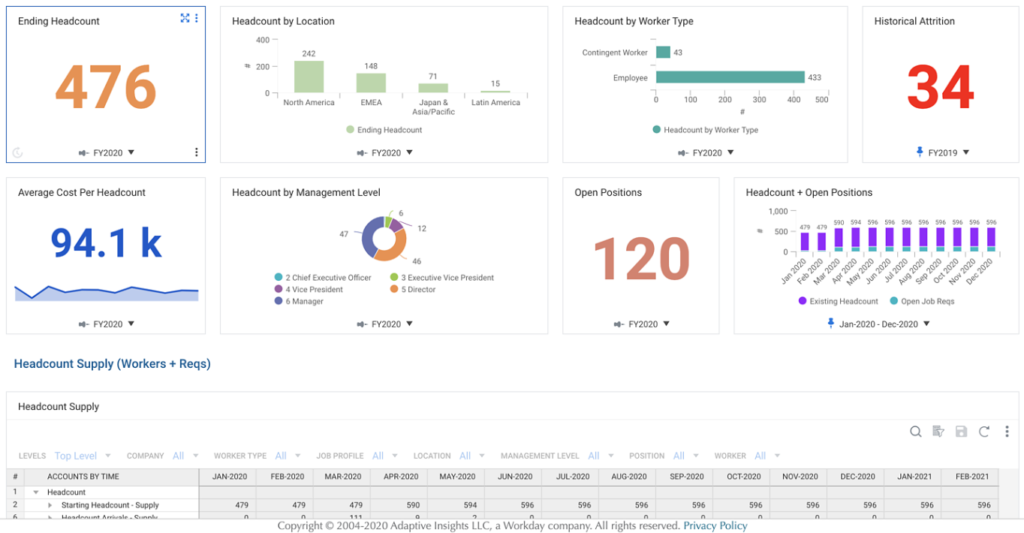

Tool Category 3: Workforce Management Tools

Workforce management (WFM) is the process of tracking company activities to optimize the performance of employees. This includes management of field services, human resources, training, performance, recruiting and budgeting efforts, forecasting, and scheduling. This is done in a WFM system, where all the necessary data is entered and analyzed.

For example, the time spent working by each employee would be stored in WFM and conclusions on predicted future workload, new hire needs, task delegation, and scheduling can be drawn. This ties directly into FP&A, as these predictions must be factored into the future budgeting plans.

Workday Payroll and Workforce Management is a great tool to execute these processes all in one place. This system allows for time-consuming workforce management tasks to be automated and provides reliable insights and analytics. Source.

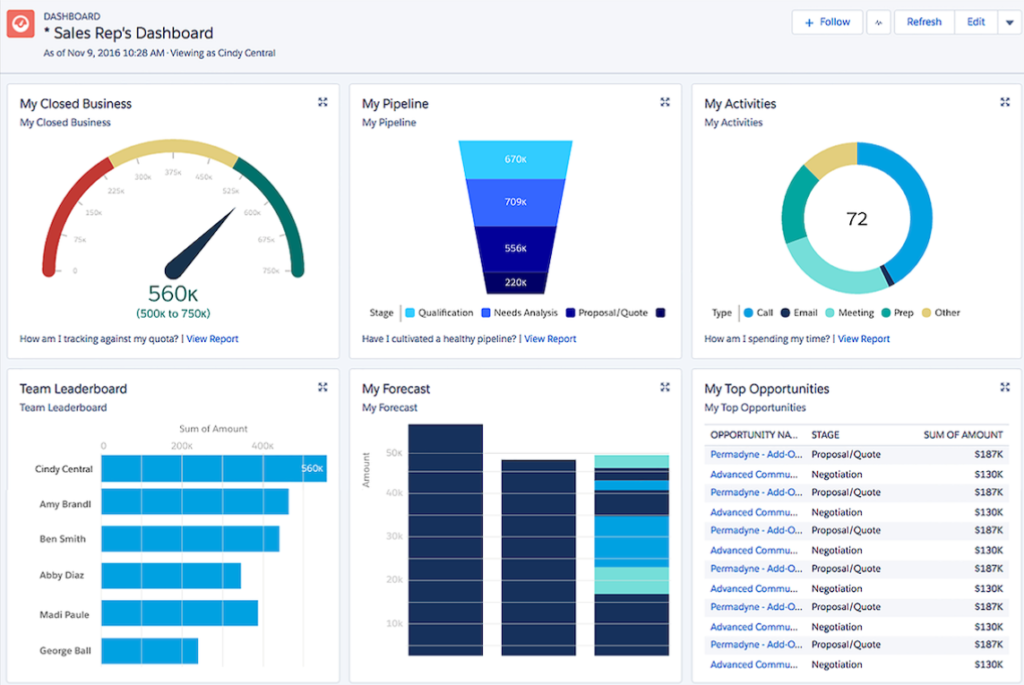

Tool Category 4: Customer Relationship Management Tools

Customer relationship management (CRM) tools help monitor your relationship with current, previous and potential customers. The goal of a CRM is to improve customer relations for a benefit of your business. CRM applications help maintain your pipeline of potential and recurring customers as the sales team stores and maintains leads, as well as helps managers and representatives track progress on customers. The CRM can be an effective compliment to your FP&A team as this information is directly used when forecasting future revenue and sales plans.

There are a number of effective CRMs available. One of the most widely used CRMs is Salesforce as it is an industry leader and provides a number of different capabilities across a number of fields. Another commonly used CRM is Hubspot as it provides much of the same functionality for a lower price.

Tool Category 5: Data Warehouse Tools

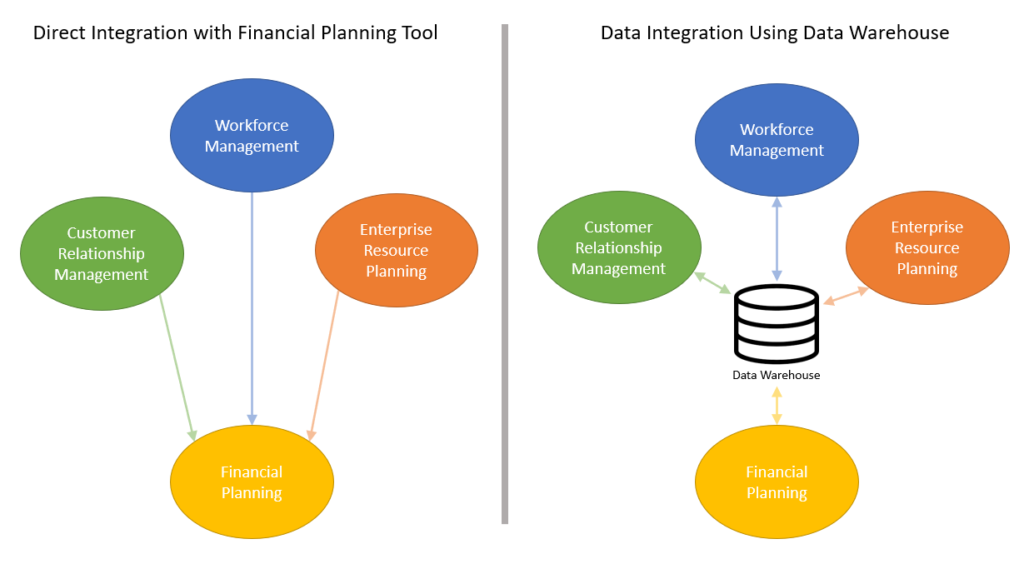

Data warehousing is the process of compiling information into one secure electronic storage location, known as a “data warehouse.” The objective of data warehousing is to create a single trove of all historical company data which can be accessed and utilized at any point, which is especially useful for FP&A purposes. The data from all four system types listed above is copied into the data warehouse through the process known as ETL (extract, transform, load). This allows the other, more specific tools to remain organized with only the necessary data for that function so that operating speed is optimized for day-to-day use by employees.

Snowflake is a popular data warehouse, provided as a software-as-a-service (SaaS), meaning there is no additional hardware or software to select, install, or manage. It is simply built on top of Amazon Web Services or Microsoft Azure cloud infrastructure. Snowflake is also unique for its variety in data sharing plans and the ability to scale storage and computation abilities independently, so these functions can be paid for separately depending on the needs of your company.

Financial Planning and Analysis Tool Benefits

When developing your arsenal of FP&A tools there are a number of competitors to choose from, and each tool provides different benefits. When choosing the right tool for your organization there are a few key components that cannot be overlooked. In order to optimize productivity, it is important that your tools allow for an automated exchange of data between systems, increased business agility, and collaboration across departments.

Automated Exchange of Data Between Systems

A key benefit of FP&A tools is the automated exchange of data between systems. This sharing of data provides for single sources of truth that holds all relevant information in one interface. As a result, no time is wasted waiting for data to be compiled, and instead FP&A teams can move directly into analysis in support of decision making. Using a system that automatically updates data as it becomes available also helps empower and build confidence within FP&A teams as they don’t need to spend time manually manipulating and verifying data from various sources.

Create An Agile Way of Working

The goal of a great FP&A team is to create an environment conducive to business agility. To be agile in the corporate world means that you are able to quickly iterate plans, accelerate planning cycles, and respond quickly to your changing needs. It is important that your FP&A tools have features that provide these benefits. These tools not only need to have up to date data but must also be easy to use in order to add the most value to your business.

Finally, tools must be customizable, as it is important that your tools work with you and not against you. With the right tools you will be able to scale your analytics as your business grows, leading to a more standardized and efficient practice within your organization.

Collaborate Across Your Organization

As more and more tools are added to your business it is important that teams are not getting bogged down in the intricacies of each tool. One key benefit to a strong FP&A tool is the ability to collaborate across your departments and their many software applications. When this is the case, individual departments can focus on their job and trust that the tools will communicate with each other to provide the most accurate depiction of company operations to managers and FP&A teams.

For example, when tools can collaborate across your organization, sales teams can spend their time updating CRM system while accounting teams can focus their time in their ERP system while at the same time keeping FP&A teams up to date with information pertaining to a company’s financial plan.

Gain Efficiencies & Improve Accuracy in Your Financial Planning and Analysis

Finally, as your FP&A team continues to learn and improve its operations, it is important that your software grows with you. This can happen in a number of ways. Whether it is improving predictions through the use of historical data and slight changes to modeling functions, or the continued creation of intelligent automations, it is important that your plan remains fluid and dynamic.

Would you like to see how a financial planning solutions provider can help you efficiently implement a corporate FP&A system? Click the button below to schedule a quick call.